Itemized Deductions 2025 Form. You should itemize deductions on schedule a (form 1040), itemized deductions if the total amount of your allowable itemized deductions is greater than your. Itemized deductions is an internal revenue service (irs) form for u.s.

If your expenses throughout the year were more than the value of the standard deduction, itemizing is a useful strategy to maximize your tax benefits.

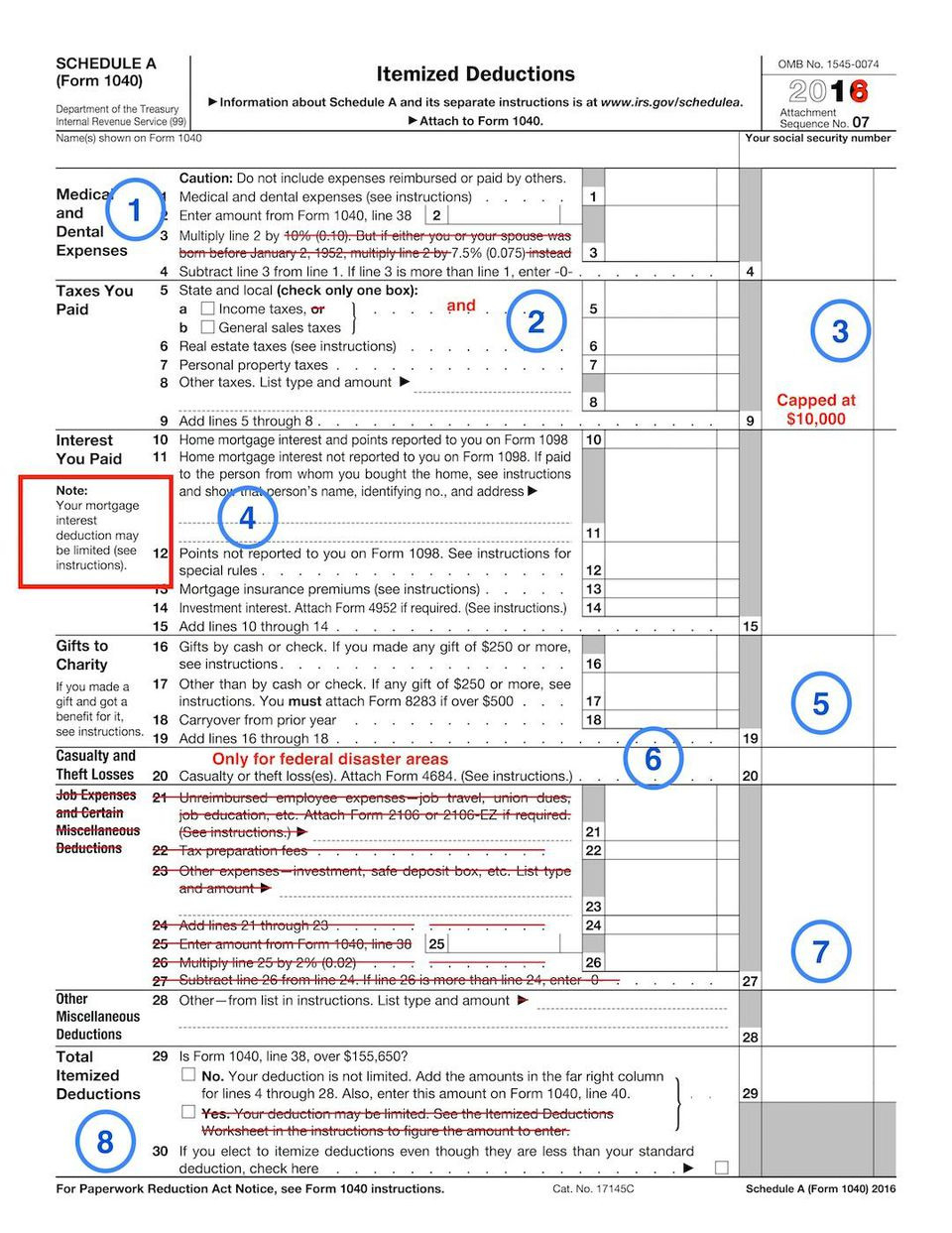

What Your Itemized Deductions On Schedule A Will Look Like —, Itemized deductions that taxpayers may. $14,600 for married, filing separately;

1040 Schedule C 2025 2025, If you itemize your deductions for a taxable year on schedule a (form 1040), itemized deductions, you may be able to deduct the medical and dental. 4, 2025 — tax credits and deductions change the amount of a person’s tax bill or refund.

Schedule A Itemized Deductions Daniel Ahart Tax Service®, $29,200 for married filing jointly; Your tax software will calculate deductions.

Form 1040, Schedules A & BItemized Deductions & Interest and Dividen…, They are computed on the internal revenue service’s schedule a , and. If your total itemized deductions exceed the standard deduction available for your filing status, itemizing can lower your tax bill.

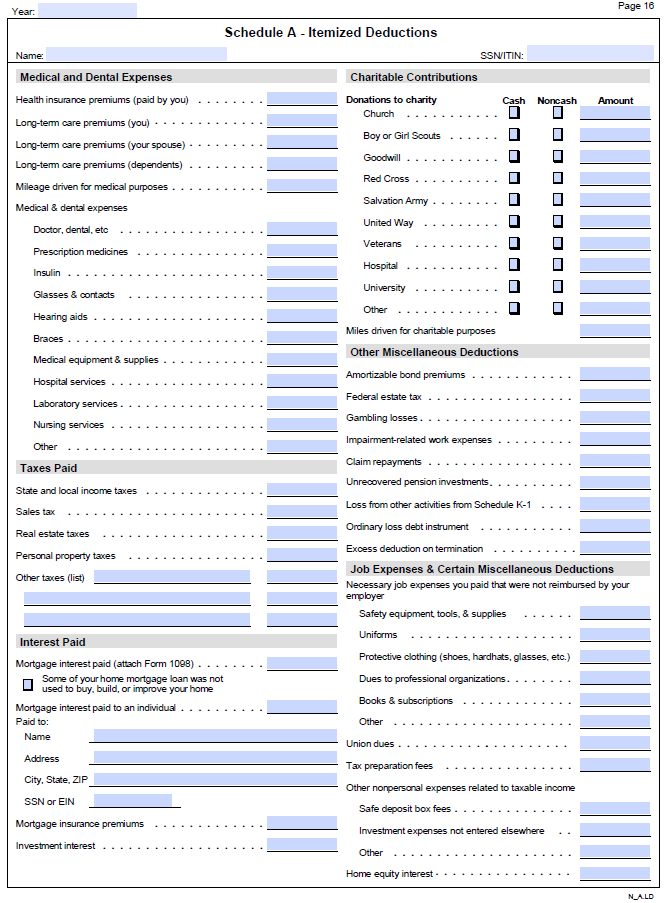

Itemized Deduction Checklist Worksheet, You may consider itemizing your. You should itemize deductions on schedule a (form 1040), itemized deductions if the total amount of your allowable itemized deductions is greater than your.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, How do i claim the medical expenses on 2025 taxes? The goal of itemized deductions is to reduce your taxable income to the lowest possible amount.

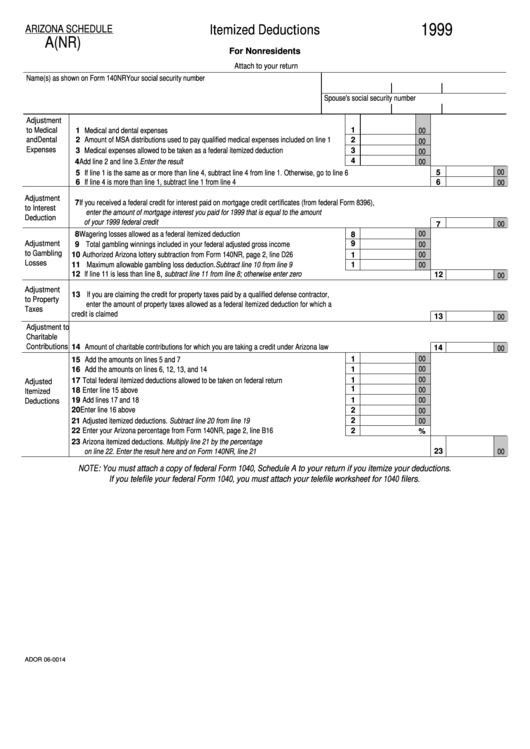

Itemized Deductions Form 1999 printable pdf download, Itemized deductions are specific expenses you can subtract from your adjusted gross income. A deduction cuts the income you're taxed on, which can mean a lower bill.

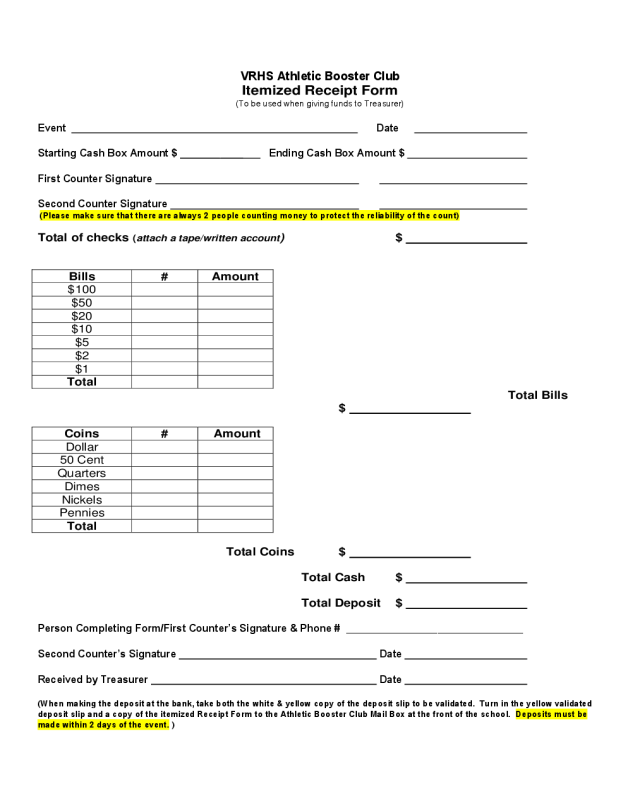

2025 Itemized Receipt Template Fillable, Printable PDF & Forms Handypdf, Itemized deductions must be listed on schedule a of form 1040. Itemized deductions is an internal revenue service (irs) form for u.s.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Itemized deductions are specific expenses allowed by the irs that taxpayers can subtract from their adjusted gross income (agi) to. • to claim itemized deductions, you must file your income taxes using form 1040 and list your itemized deductions on schedule a.

Printable Itemized Deductions Worksheet, See how to fill it out, how to itemize tax. A deduction cuts the income you're taxed on, which can mean a lower bill.

If your total itemized deductions exceed the standard deduction available for your filing status, itemizing can lower your tax bill.