Tax Brackets 2025 Head Of Household. Marries filing jointly or qualifying widow tax brackets: If you are married, you must file as married, even if you were.

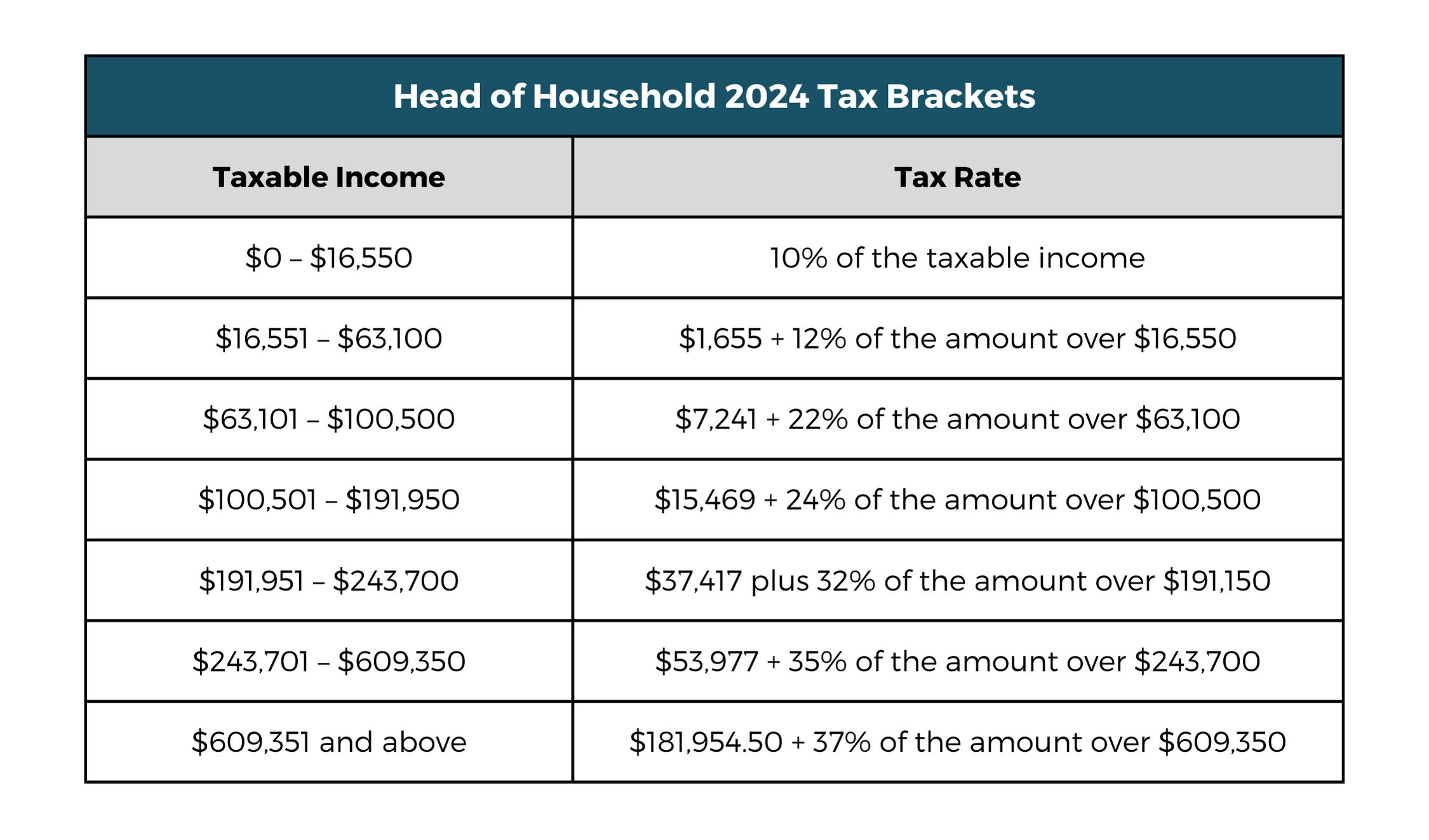

The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. The top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher than the 3.3.

2025 Tax Code Changes Everything You Need To Know RGWM Insights, Rate married filing jointly single individual head of household married filing separately; Taxable income (married filing separately) taxable income.

2025 Tax Brackets Married Filing Jointly Fey CarolJean, Exemption phaseout thresholds, and statutory marginal tax rates, 2025 personal exemption and phaseout threshold: There are seven (7) tax rates in 2025.

Tax Rate In California 2025 Blisse Zorana, November 13, 2025 · 6 min read. How federal tax brackets work;

Federal Tax Earnings Brackets For 2025 And 2025 bestfinanceeye, 2025 tax brackets (due april 15, 2025) tax rate single filers married filing jointly* married filing separately head of household; Below, cnbc select breaks down the updated tax brackets of 2025.

Minimum To File Taxes 2025 Californian Vida Lavena, You’ll notice that the brackets vary depending on whether you are single, married or a head of household. See current federal tax brackets and rates based on your income and filing status.

How Much Will I Pay In Taxes 2025 Lola Sibbie, Head of household filers have more generous tax brackets than single or married filing. So how do the tax brackets and deductions work?

New 2025 IRS Tax Brackets And Phaseouts, Tax brackets and tax rates. You pay tax as a percentage of your income in layers called tax brackets.

2017 Ine Tax Brackets Canada Tutorial Pics, The top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher than the 3.3. Rate married filing jointly single individual head of household married filing separately;

New Tax Brackets 2025 Australia Vilma Jerrylee, Married couples filing separately and head of household filers; Below, cnbc select breaks down the updated tax brackets of 2025.

Capital Good points Tax Brackets For 2025 And 2025 Nakedlydressed, Marries filing jointly or qualifying widow tax brackets: $0 (suspended through the end of 2025).

Tax rate single head of household married filing jointly or qualifying widow married filing separately;